Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

A Reminder from a Survivor

Hey Scott,

I read your book at 21, bought a home at 26 … then got cancer at 34. Following the Barefoot steps made my diagnosis manageable. Three months of saved expenses (Mojo) saw me through treatment until my Income Protection kicked in. No financial pressure to return to work whilst I continue immunotherapy.

Hey Scott,

I read your book at 21, bought a home at 26 … then got cancer at 34. Following the Barefoot steps made my diagnosis manageable. Three months of saved expenses (Mojo) saw me through treatment until my Income Protection kicked in. No financial pressure to return to work whilst I continue immunotherapy.

However, sharing my story with friends (most with large mortgages and small children), it terrifies me how many don't have adequate Income Protection.

My message: spend 30 minutes checking your super fund's default cover. Ask yourself if it's enough when the worst happens. You never want to claim it, but if you need it, it's a financial life raft.

Ellie

Hi Ellie,

This is important.

I don’t want to put the mozz on anyone, but Ellie didn’t think this was going to happen to her either.

I consider this a Public Service Announcement from a tough as nails survivor.

Act accordingly.

Thank you for reading!

How on earth did I get here?

"Bugger."

The engine warning light lit up like a 2-cent pokie jackpot.

"Bugger."

The engine warning light lit up like a 2-cent pokie jackpot.

Then our 4WD shuddered and lurched – kind of lurch you get when a barefoot dad stomps on Lego during a midnight dunny run.

"Daddy, I'm scared!" wailed my daughter from the back seat.

"We'll be fine," I lied, summoning my bravest Dad voice.

We were deep in the Never Never. The dash said 35 degrees.

My phone said no reception.

As we crawled along the red dirt track, the only signs of civilisation were wrecked cars, abandoned and left for dead.

How did I get us here?

Well, a few months earlier, my brother-in-law rang from a remote Indigenous community where he’d scored a teaching gig. “You should come visit,” he said.

I punched it into Google Maps: 3,720 kilometres. Forty-five hours.

"Driving? Hell no," said Liz – the handbrake in our household.

And yet here we were. Two adults. Four kids. A camper trailer built for two.

What was I thinking?

I was thinking my kids live in a bubble – and sometimes it’s good to pop it.

Eventually we limped into town – my diesel filter dirtier than my conscience for dragging the family out here – and our collective silence said more than words.

The kids went to the local school for the week. They made friends. My footy-mad son reckons he saw some of the best players of his life. My daughter came home barefoot… because that’s what all the girls did. Kids are kids.

Except these kids live in houses with up to twenty people. Often no beds. No fridge. Sometimes no front door. A place where hardly any adults work, black-market bottles of rum go for a grand, and the only shop sells frozen bread for fifteen bucks and milk for ten.

None of this is their fault. Like my kids, they were born in one of the richest countries on earth – but their futures will be shaped by forces they never chose.

Same sun. Same soil. Different worlds.

Tread Your Own Path!

Wally retires

Twenty years ago I had a meeting with a book publisher.

It turned out to be one of the luckiest days of my professional life.

Twenty years ago I had a meeting with a book publisher.

It turned out to be one of the luckiest days of my professional life.

Not because they gave me a book deal, or good advice …

“You write in one sentence paragraphs … it’s just horrible” the publisher said, screwing up his nose.

(Still do!)

No, it was because he hated my writing so much that they paired me with his best editor, Wally, in the hope he could polish a turd.

We clicked – Wally (unlike the publisher) got my style straightaway – and we’ve been working together ever since.

Life comes at you fast. Back then, Wally was roughly the age I am now, living the dad taxi life. This year he officially retired … and now I’m in the driver’s seat, doing the school pick-ups.

In the lead up to his retirement we’ve spent quite a bit of time simplifying his portfolio, lowering his fees, and ensuring he has three years of living expenses at hand to ride out any Trump slumps.

However, we’ve devoted even more time to avoiding what I think is the biggest mistake retirees make … and it has nothing to do with money.

Most people spend years making sure they’ve got enough superannuation to never work another day in their life. Yet they don’t spend a single day planning what they’re actually going to do.

I remember my old mate, former Deputy Prime Minister Tim Fischer, telling me before he retired: “I’ve spent the last 12 months preparing for my retirement.”

“Surely you’d be on a good pollie pension”, I joked.

He gave me that classic Tim stare. “I’m not talking about finances, Scott. You need to treat your retirement like it’s a full-time job.”

At the time, I thought he was being cute.

But Tim was never cute. He was wise. And he was dead right.

I’ve had thousands of conversations with retirees, and I can tell you the happiest ones are not those with the biggest SMSF balance – they’re the ones with purpose and a plan:

Monday morning, 9am. What’s in your diary?

Someone once said that when blokes retire they default to the ‘3Gs’: golf, gardening and grandchildren. The problem is that none of these are full-time pursuits. (And, as the owner of four energetic grandkids, I can confirm they’re best enjoyed casually, not part time.)

Tim had it right: treat retirement like a job – just one with unlimited holidays and no annoying colleagues (well, apart from your co-CEO spouse).

This week Wally returned from his first official tour of duty as a retiree: four weeks in Venice, eating gelato with the rest of the Aussie boomers.

“I read this book called The Barefoot Investor on the plane”, he told me.

“Go on”, I said.

“And apparently one of the riskiest things a retiree can do is to completely turn off the income tap”, he said. “Besides, your columns still need a bit of polish”, he said.

Tread Your Own Path!

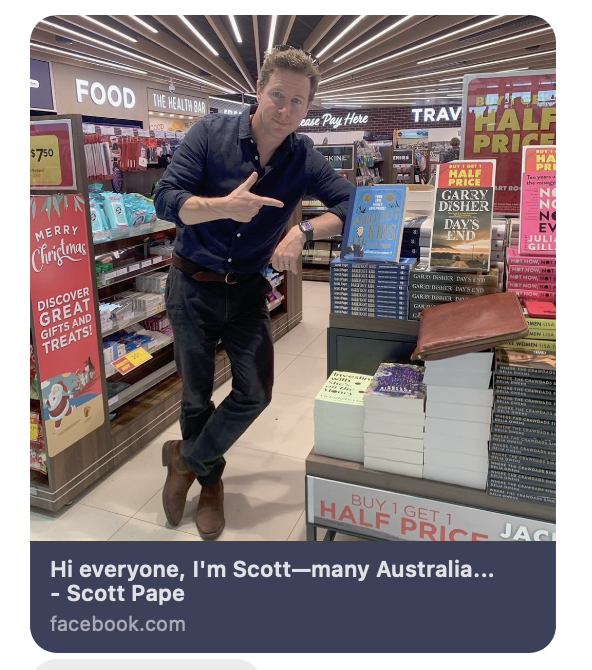

P.S. SCAM ALERT

In just a few days, 1,200 people have been tricked by a fake me on Facebook.

They’re running a “pig butchering” scam — fattening you up with fake trading tips on WhatsApp before stealing your money.

If you see my face promising easy money… it’s a butcher in disguise.

Don’t click. Don't like. And if this page pops up in your feed, please do me (and a lot of others) a favour — report it.

Bridget Jones Scores $900

Hi Scott,

I love your columns and still use your buckets 10 years after reading your book. I’ve saved and paid off my debts, but your email today was perfect timing.

Hi Scott,

I love your columns and still use your buckets 10 years after reading your book. I’ve saved and paid off my debts, but your email today was perfect timing. Last week, I put on my Bridget Jones big girl pants, called my insurance company, and questioned a $500 premium hike. After seven years of loyalty I was ready to switch, and they offered me a $900 discount – cheaper than any other quotes I had. I danced around my kitchen with joy! Thank you for empowering me to question big companies and say, “That’s not good enough, I want to pay less”.

Kathryn

Hey Kathryn, You, my friend, just pulled off the ultimate power move – pants on, phone in hand – and now you’re $900 richer. And you’re not alone – I’ve been inundated with stories of people saving hundreds with my five-minute call. Now, a quick Public Service Announcement (PSA): Some readers pointed out that turning off auto-renew could mean forgetting to renew altogether. Don’t stress – your insurer will remind you. Yet, just to be safe, set a phone reminder for 11 months from now so you can rinse and repeat the savings next year.

Scott

Are You Okay?

“Are you okay? If you need a hand with anything, call.”

I stared at the text while I stood ankle-deep in a kiddie pool, orange juice in hand.

“Are you okay? If you need a hand with anything, call.”

I stared at the text while I stood ankle-deep in a kiddie pool, orange juice in hand.

I was at a kids’ birthday party. The sender? A farmer who lives 20 clicks from me.

Then Liz came out with her party hat on and said:

“There’s an out-of-control fire near the farm … and the wind is blowing in the wrong direction.”

I nervously sipped my juice while my family gave me my marching orders:

I was told to go home and collect a stuffed cheetah, two teddy bears, and a prized poster of Kysaiah ‘Kozzy’ Pickett. Oh, and the passports. (“Dont’ forget the the damn passports!”)

I’ll be honest, as I drove back to the farm I was slightly freaked out.

Still, a lot of people all over Australia have been feeling this way lately: with the cyclone, floods and fires (thankfully the fire near our place was eventually contained). And even if you haven’t – you sure as hell have been burned by your insurer. As one Barefooter wrote to me recently:

“Our home Insurance has tripled – from $400 per month to over $1,200. Why is no one talking about this?! You can't even get a mortgage without having insurance, so there is no way out!”

Sheizenhowzen!

Over a third of insurers have increased prices by more than 15% in the last year (the worst hikers according to CHOICE were Kogan, RAC and Honey).

Now that doesn’t sound too bad right?

Well, hold my OJ:

In a recent ‘shadow shop’, CHOICE found the biggest price difference between identical home and contents insurance policies wasn’t double or even triple … it was TWENTY TIMES.

Blitzenschnauzer!

Okay, so here’s what I want you to do.

First, load up Mr Inbetween on Binge (thank me later), grab your preferred brew, get your phone out of your pocket, and take prime position on the La-Z-Boy. We’re going to do some multi-tasking.

1. Grab your home and contents policy (or just contents if you’re renting) and find your ‘sum insured’ – that’s the total amount you’re covered for. Write it down.

2. Next, google three quotes.

3. Right-yo, it’s time to get off the recliner. Grab your phone and film your place like you’re making a true-crime doco – open cupboards, dig through drawers, and don’t forget the garage. If you ever need to claim, this footage will be worth its weight in gold.

4. Then walk outside and act like a meth-head casing the joint: Do you have a yappy dog? Deadbolts on the door? Security cameras? Note down anything you’ve done to Fort Knox your home.

5. Then call your insurer and follow this script:

You: “Hi, my name is [Your Name] and I’m really struggling to afford my home and contents insurance policy. I’d like to discuss how we can reduce my premium. My policy number is XYZ.”

Insurer: “I’d be happy to help.”

You: “After a lot of research, I’ve found comparable coverage from other insurers at more competitive rates. Additionally, I’ve implemented several safety measures in my home, such as [consult your meth-head list]. Given these factors, I’m seeking a reassessment of my premium.”

Insurer: “Let me review your policy and see what adjustments we can make.”

Cue condescending loop of a voiceover woman saying “Your call is important to us".

Insurer: “Thank you for your patience. Based on the information provided, we can offer a premium reduction of [amount].”

You: “I appreciate that. However, considering the competitive quotes I’ve received, plus the safety enhancements I’ve made, I believe there’s room for a more substantial reduction. Additionally, I’m willing to increase my excess, which should further lower my premium by at least an additional 10%.”

Insurer: “I understand. Let me see what more we can do.”

James Blunt’s “You’re Beautiful” plays.

Insurer: “After further review, we can offer an additional discount, bringing your new premium to [new amount].”

You: “Now we’re talking. Send me that in writing and we’re good.”

Insurer: “Done! Anything else?”

You: “Yes, please cancel my auto-renew immediately.”

Insurer: “Are you sure? That’s how we screw you next year.”

In the time it takes you to watch the first episode of Mr Inbetween, you should be able to save yourself hundreds and potentially thousands of dollars.

There’s only one thing left to do. My final instruction is to send me an email at scott@barefootinvestor.com and tell me how much you saved. I’ll report back next week.

Tread Your Own Path!

You're Out of Touch, Barefoot

I read your latest column and wasn’t that impressed with your ‘forget about it’ number of $100. Even though I earn $175,000 a year, I’m the type who hunts for bargains even if it’s just saving a few bucks.

Scott,

I read your latest column and wasn’t that impressed with your ‘forget about it’ number of $100. Even though I earn $175,000 a year, I’m the type who hunts for bargains even if it’s just saving a few bucks. Sure, I won’t fund a house deposit by filling up on cheap petrol or buying half-price snacks, but that mindset has kept me from wasting money on non-essentials – and it’s worked. If I want to buy something unnecessary (like an omelette maker), I wait two weeks to make sure it’s not just FOMO, marketing hype, or a passing obsession with the perfect omelette. It would be good to hear about what non-negotiable rules might be more relevant to everyone else who reads your newsletter.

Sarah

Hi Sarah,

My idea is to create your own money rules that become habits … and that the best way to build habits that stick is to make them part of your core identity.

So I’m guessing part of your identity is that you’re smart with money (though your friends may refer to it as being a total ‘tight-arse’. After all, you’re in the top tax bracket but you’re out there bartering with the checkout lady over dented canned goods.)

But hey, you do you!

Frugality is great if it’s intentional and not just a lifelong habit of financial paranoia. My point isn’t to waste money – it’s to not waste mental energy on small purchases that don’t matter in the long run.

Scott.

What are your Money Rules?

“Jeez, mate … what the hell happened to you?” I said to Benny, an old farmhand I once employed.

He’d shed so much weight since I last saw him that he looked like he’d been kidnapped by a pack of Pilates instructors.

“Jeez, mate … what the hell happened to you?” I said to Benny, an old farmhand I once employed.

He’d shed so much weight since I last saw him that he looked like he’d been kidnapped by a pack of Pilates instructors.

“You been getting the Hollywood Shot?”

Blank stare.

“You know … Ozempic?”

More silence.

He shrugged. “Nah, mate. I just don’t eat after 5pm.”

“That’s it?”

“Yep. I used to binge on crap and drink too much at night. So I made that rule. And I’ve stuck to it for the best part of a year”, he told me.

Winner, winner, (no) chicken dinner!

Now Benny has unintentionally stumbled upon something pretty profound: the power of personal rules. A simple, clear-cut rule can short-circuit the endless decision-making process and make life easier.

This is exactly the thinking behind the mega-bestseller Atomic Habits by James Clear. His philosophy is simple: instead of focusing on goals, focus on your identity. “Every action is a vote for the type of person you want to become”, he says. And the best way to cast those votes? By making your habits automatic.

For years I’ve applied this thinking to money. I don’t rely on willpower – instead I’ve created my own Money Rules. These are automatic, non-negotiable rules that keep our finances (and my sanity) in check.

Let me share a couple with you:

We (still) go on a Date Night on the first Tuesday of every month

Yes, the same day as the Reserve Bank meeting (super romantic). But, despite having four kids under 11 and a life that’s a total shemozzle, we make it happen. Every action is a vote for the type of relationship we want, and a monthly Date Night is a vote that we’re connected, committed, and eating food that hasn’t been touched by tiny fingers.

We buy shares every month

On the day after our Date Night, I buy shares (index funds of course). Some months it’s a lot, some months it’s a little. The point? I’m an investor, so I invest. I don’t try to time the market. I just stick to the habit.

We give every month

Giving isn’t just about charity – it’s about breaking the chains of materialism, feeling grateful, and ensuring our kids don’t grow up to become contestants on MAFS. Talking about giving is as normal in our family as talking about spending.

We can spend $400 without asking each other

Liz and I famously share the same bank account. That can at first sound kind of creepy, but we do it because it forces us to have chats about money (like when Liz is at the hairdresser and suddenly realises there’s not enough in the account). We’ve set a $400 no-questions-asked spending limit. Anything over that, we chat about on Date Night. It works for us, but let’s be clear – joint accounts aren’t for everyone, especially in abusive relationships.

We don’t stress over omelettes

Even after nailing all the Barefoot Steps, I can still catch myself sweating the small stuff – like spending two hours researching a $45 omelette-maker, or spiralling into a pit of despair from copping an excess baggage fee on good old ‘Onestar’. So, I created a ‘forget about it number’: if it’s under $100, I let it go. My time and sanity are worth more than a few bucks, and yours probably are too.

Benny, my old farmhand gets it: one simple rule changed his life. No fancy diet apps, no expensive medication – he made a decision once, and then let his rules do the rest.

Now it’s your turn.

On your next Date Night, create your own Money Rules. What spending makes you happy? What decisions do you want to make automatically? What would make your daily life easier?

Remember, you become what you repeatedly do. Your rules, your identity.

Tread Your Own Path!

Best Christmas Present Ever!

Last year we got a Christmas gift that changed everything: The Barefoot Investor. And what a year it’s been. My 20-year-old son is now the proud owner of his first piece of land, having already paid off half the loan while keeping his emergency fund intact.

Scott,

Last year we got a Christmas gift that changed everything: The Barefoot Investor. And what a year it’s been. My 20-year-old son is now the proud owner of his first piece of land, having already paid off half the loan while keeping his emergency fund intact. My wife and I are about to take our second holiday, fully funded by our Smile account, and we’ve dramatically reduced our insurance costs. On top of that, we boosted our super by $30,000, ditched our credit cards, and wiped out every bit of other debt we had. Your book opened our eyes to the possibilities, and now we’re living a life we couldn’t have imagined. Thank you!

Mel

Hi Mel

Wowsers, what a year you guys have had! You definitely deserve some eggnog this Christmas. It’s really cool that after all these years the book is still having a real and lasting impact on people. There are a lot of people doing it tough this Christmas, so hopefully they can follow your example and make 2025 their year.

-Scott.

Young and Stupid

Our Year 12 economics teacher just read out one of your Q&A newsletters in class. An 18-year-old guy had written to you confessing he’d spent $8,000 on a credit card.

Hi Scott,

Our Year 12 economics teacher just read out one of your Q&A newsletters in class. An 18-year-old guy had written to you confessing he’d spent $8,000 on a credit card. He said he felt a burden to share it because many Aussie teens fall into the same trap. It dawned on me that I’m now eligible for a credit card too. The $$$ symbols flash before my eyes, just for a moment. It clearly illustrates just how easy it is to fall into stupid mistakes being young, and I really don’t want to be stupid. So I’m simply writing to say thanks. I’ll definitely be getting your book!

Annie

Hi Annie

You’re right, you can get ahead of most people in life simply by avoiding doing the ‘stupid’ stuff. That’s how people stay in loving relationships, out of jail, away from debt collectors, and with their adult teeth intact.

Yet if you really want to thrive, and live an amazing life, you need to go one step further. You need to actively build up the belief that you, Annie, are a really savvy woman with money.

How do you do that?

You prove it to yourself with the little actions you do, starting today.

Yes, you avoid credit cards, but you also open an investing app and start buying index funds. Yes, you avoid Afterpay, but you also set up your buckets and start saving for a house deposit, even if it’s years into the future.

I’m a self-serving grubby author, but I’ve always thought my book makes a good graduation present.

Good luck!

-Scott.

Barefoot Book Week!

Book Week time again and Barefoot was the only person Hamish wanted to dress as! He has read Barefoot Kids and is now nearly finished your original Barefoot Investor book.

Hi Scott,

Book Week time again and Barefoot was the only person Hamish wanted to dress as! He has read Barefoot Kids and is now nearly finished your original Barefoot Investor book. He has all his buckets and a great plan. Keep inspiring my kids, please!

Nicky

Hey Nicky,

I absolutely love Book Week (and Father’s Day).

Every year I get kids who dress up as me (well, except for my kids, who think I’m super embarrassing).

Please thank Hamish for reading both books, and let him know that I think he’s a legend.

(And a shout-out to all the other kids who had a Barefoot Book Week too.)

Scott.

Mum Won’t Give Me $30,000 Because of YOU, Barefoot

My mum is withholding a $30,000 inheritance for me from my late great aunt because she thinks I wouldn’t use it the ‘Barefoot way’. I’m a 26-year-old woman, living with my partner, and we have money of our own saved up for a house deposit.

Hi Scott,

My mum is withholding a $30,000 inheritance for me from my late great aunt because she thinks I wouldn’t use it the ‘Barefoot way’. I’m a 26-year-old woman, living with my partner, and we have money of our own saved up for a house deposit. I told my mum that, if she gives me the $30,000 from my great aunt, I would also put it in our high-interest savings account to earn interest until we buy a house. But she says you would tell me to invest it in shares or use it to pay off my HECS. Is that true? Until I agree to the ‘Barefoot Way’, she’s not going to let me have it.

Olivia

Hey Olivia

Order! Order!

Judge Barefoot is in the house. Please all rise, while I give the verdict:

In the matter between you and your mother, I find in favour of …. YOU!

You are up to Barefoot Step 4: Buy Your Home, so you should definitely put the inheritance towards your house deposit savings in an online saver.

Once you’ve done that, you’ll move up to Step 5: Increase Your Super to 15%. That’s when you’ll be tax-effectively investing long term into the share market via your low-cost super fund.

Well done, and please say g’day to your mum for me!

Scott.

Screen-free Sunday

I wanted to let you know we were impressed with Screen-free Sunday and have instituted it for the second week running. (Though my kids point out that it should be followed swiftly by Mum-free Monday!)

Dear Scott,

I wanted to let you know we were impressed with Screen-free Sunday and have instituted it for the second week running. (Though my kids point out that it should be followed swiftly by Mum-free Monday!) I just can’t get over how many families don’t do it, and I suspect it’s because many parents are attached to their devices too. In fact, that’s what is revolutionary about Screen-free Sunday – everyone has to participate!

Kelly

Hey Kelly

Congratulations!

We’re still doing it as well – and, like you, loving it! The only problem we’ve encountered is when the Melbourne Demons are playing an away game. My daughter is very much a stickler for the rules, which means we have to listen to it on the tranny!

Scott.

How I Keep It Hot in the Bedroo

“Why am I so hot?” said Liz, bolting upright in bed the other night. “Perhaps it’s early menopause?” I giggled back into the darkness.

“Why am I so hot?” said Liz, bolting upright in bed the other night.

“Perhaps it’s early menopause?” I giggled back into the darkness.

Silence.

I could feel my wife’s (mental) temperature rising.

“I bought us an electric blanket,” I confessed. “It’s pretty toasty, right?”

“That is such an old person thing to do,” she said, rolling over and giving me a warm shoulder.

Truth be told, this night had been a long time coming. You see, I have PTSD from staying over at my grandparents’ house when I was a little tacker. As Nana would turn up the wiry electric blanket, my big sister would hiss at me, “Remember, if you wet the bed tonight you’re going to electrocute yourself”.

From that point on, I slept with one eye open.

Thankfully, I’m over that now (plus, I figure I’ve got another 25 years till my prostate starts playing up), so I’m good to go.

Yet there was one real problem:

Electric blankets are known to cause fires, which is quite terrifying really.

So how do you find a good one? (I mean, one that won’t take you from toasty to toasted.)

Well, I bought the Dimplex DreamEasy Electric Blanket, which cost $75.

Why?

Because the Dimplex scored the highest rating from CHOICE testers, and they don’t give them out easily.

They looked at heaps of electric blankets and put them all through a series of safety, comfort and electrical testing, which included taking thermal images to see how they disperse heat, measuring energy consumption (mine will apparently cost $61 to run through the 92 days of winter), and even building a custom-made rig that simulates 5,000 cycles of the cord flexing and pulling under a weight of 10 newtons (around 1kg).

Then they performed a current leakage test. ZZZZT!

Contrast this to the reviews you get from the Wild Wild West (aka the World Wide Web).

A report from the World Economic Forum (WEF) found that writing fake online reviews is a well-organised multibillion-dollar business. In response to this, in 2022 alone Amazon blocked more than 200 million suspected fake reviews and Google blocked or removed more than 115 million. Yet now artificial intelligence is being used to write fake reviews en masse and pollute the internet.

So here’s my take:

The sort of in-depth testing that CHOICE does across 200+ categories – without getting a kickback or even a freebie from the manufacturer – costs a lot of money. And that’s why I’m happy to pay my $84 annual membership. Not only does it save me hundreds of clams each year, it also keeps me warm in bed each night!

Tread Your Own Path!

Au Pair? Au Contraire!

I’m 19, au pairing in the UK and preparing for a three-month backpacking trip around Europe. Living the dream, right! Except that by the time I get back to Australia I’ll have just about used up my savings.

Hi Scott,

I’m 19, au pairing in the UK and preparing for a three-month backpacking trip around Europe. Living the dream, right! Except that by the time I get back to Australia I’ll have just about used up my savings. I have this little voice whispering in my ear that I should be working towards setting myself up for the future, and travelling definitely doesn’t feel like I’m doing that! I have an index fund and I save as much as possible, but I am having that classic existential crisis of what the bloody hell to do with my life now! And by ‘now’ I mean when I go back to Australia (and reality). So, what snippet of wisdom do you have for me, Scott?

Mindy

Hi Mindy

You know that little voice whispering in your ear?

It’s a very good thing. Most broke people don’t have that voice (instead they have advertisers and influencers whispering in their ears).

However, I don’t think you should listen to it for the next year or two. Fact is, you’re only 19 once, and this is your time to go out and experience all the amazing things this world has to offer.

Case in point: I often employ backpackers to work at my farm … they camp at the shearing shed, sleep in their vans, eat on camp stoves and have cold showers. Yet they look at me with my wife and four kids, and the basketball, ballet and cricket practice … and pity me!

When you’re travelling you’re growing as a person, both from gaining a more worldly perspective and from learning how to make your money stretch, which will pay dividends throughout your life.

My view?

Don’t bank dollars, bank experiences for the next few years. Australia will still be here when you get back!

Scott.

Holy Moly!

Last week I challenged you to do ‘one thing’ towards what you’ve been putting off, and then email me and let me know what you did.

Strike me pink!

Last week I challenged you to do ‘one thing’ towards what you’ve been putting off, and then email me and let me know what you did.

Strike me pink!

Sitting back on the farm, tapping this little note each week to you, it’s easy to forget how many of you there are out there in the wilds. (My inbox got absolutely destroyed … in a good way.)

Here are some of the things people have got off their rumpus and done:

“I’ve been a stay-at-home mum for almost seven years. My ‘one thing’ is I’ve now enrolled in TAFE to reskill myself”, says Tania.

“I got suckered into a high-pressure sales pitch for a super fund years ago. I knew it was a bad idea, but I felt so ashamed and stupid that I just ignored it. This week, I called them up and transferred to AustralianSuper”, said Paul.

“I’ve had the Vanguard Aust app on my phone for close to 12 months, but fear of the unknown has stopped me from doing anything. Now I’ve transferred $500 from my savings to Vanguard and will invest it in their International Shares Index Fund. It’s a pretty exciting feeling to be a first-time investor”, says Billy.

“I have made the list of outstanding debts and paid the first one off – the dreaded credit card. Already a sense of relief has washed over me. One small step but a step in the right direction nonetheless”, says Tom.

“I quit my executive role and took a $50,000 pay cut to be with my family more – and I couldn’t be happier!” says Linda.

“We have spoken with our bank and reduced our mortgage interest rate by 0.5%, as well as changing our repayments to fortnightly instead of monthly. It costs nothing and will saves us $$. Small steps, but they all help”, says Daniel.

“For years we felt we were inseparable from the hooks sunk into us by our financial adviser. But not today. We sat down with a known, trusted and experienced fee-for-service professional who was able to clearly lay out a pathway to extract ourselves from our SMSF (and cut some very expensive ties with our existing adviser)”, says Col.

“Today, after your email, I’ve decided to do a digital detox on my phone. I’ve deleted the three key apps that lead to 3.5 hours a day on the phone screen”, says Susan.

Bingo Bango!

Thank you to everyone who wrote in. The answers have had a deep impact on me (and my kids … I’ve been reading some out at the family dinner table). We have so many amazingly determined and inspiring people in our community. I’m still reading through them all, and I look forward to reading about your wins too.

You Got This!

Do this one thing for me

Howard Marks is one of the world’s greatest investors.

He’s so influential that Warren Buffett says that whenever Marks writes anything he stops what he’s doing and reads it immediately.

Howard Marks is one of the world’s greatest investors.

He’s so influential that Warren Buffett says that whenever Marks writes anything he stops what he’s doing and reads it immediately.

Late last year Marks wrote about a major ‘sea change’ that he believes will change everything:

“In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today.”

That sea change is what we’ve experienced this year: sustained higher interest rates.

Marks argues that the last 40 years of falling interest rates have provided investors with a wonderful wind in their sails. And, as a consequence, many people still believe that interest rates of 2% are normal.

They are not.

Inflation has put an end to our smooth sailing. Rising interest rates means we’ll soon be moving into much more treacherous waters.

So what does all of this mean for you?

Well,you need to understand that the economic winds are now blowing against you (and all of us).

So let’s focus on you, and where your ship is heading.

Yes, I’m talking to you.

You’ve been putting off making that financial decision, right?

Perhaps it’s selling that dud investment property … or downsizing from your current place.

Maybe it’s reaching out to your super fund’s financial advisor about your retirement … or making the call to get a better home loan rate.

Hopefully it’s to sell your Dogecoin … or perhaps it’s calling the Small Business Debt Helpline (1800 413 828) to admit you haven’t paid your business taxes and ask for their help.

Heck, it could even be to finally make the ultimate (diamond ring) investment.

You may tell yourself that it’s not the right time, or that you don’t have all the facts, or that you’re too busy.

Yet deep down you know they’re all excuses.

So, whatever you’ve been putting off, I want you to do something – anything – towards it this week.

Call your bank. Break up with your stoner boyfriend. Buy some index funds.

And then email me at scott@barefootinvestor.com and let me know what you did (big or small).

I promise I’ll read it.

So go on, name your ‘one thing’ you’ve been putting off, and then set sail!

Tread Your Own Path!

What Drugs Are They Smok’n?

I struggle to relate to the questions you get. A couple earning $160,000 a year can’t save 20% for a deposit, or a single mum edging up to $100,000 a year is struggling financially.

Scott,

I struggle to relate to the questions you get. A couple earning $160,000 a year can’t save 20% for a deposit, or a single mum edging up to $100,000 a year is struggling financially. What kind of expensive neighbourhood and lifestyle are you readers living?

I’m lucky if I earn $50,000 a year, and we are a single-income family with five young children. Yet we have been able to save up a 20% deposit and have purchased a house, which we are currently renting out (yes we have a mortgage that will take years to pay off, we just didn’t over-capitalise).

We travel the country in a little pop-top caravan, homeschooling our kids while I work online. I don’t believe in sponging off the government either, so we don’t put our hand out for welfare payments.

You don’t need to be earning big bucks to have a valuable life in this country, and kids don’t need to go to some posh school or have after-school care to get educated or be successful. Being able to spend time with those you love is what makes you truly rich.

Darren

Hi Darren,

You’ve discovered what a lot of people eventually work out when it’s too late:

Debt enslaves you.

And that if you can avoid being in too much debt you’ll be happier.

Life is short, and the time you have with your kids is even shorter.

You Got This!

Scott.

You’re a Total Jerk

Your answer to last week’s question from the 90-year-old man, wanting to see whether he should implement your financial plan (‘Old Dog, New Tricks’) would have to be the most insensitive, egotistical slap-back I have ever read in your column.

Scott,

Your answer to last week’s question from the 90-year-old man, wanting to see whether he should implement your financial plan (‘Old Dog, New Tricks’) would have to be the most insensitive, egotistical slap-back I have ever read in your column. The man is asking a question about finance, not asking for family therapy. He genuinely wants to get a sense of purpose, build his nest egg, and still feel there’s a reason to go on. Telling him to focus on his family and friends not only doesn’t answer the question ... it implies: “What’s the point of looking forward? You’re nearly dead anyway.”

Angie

Hi Angie

My answer to the old fella’s question was the most insensitive and egotistical thing you’ve read in my column?

Hold my beer.

So you think the reason for him to go on is to … make more money?

He already told me he was financially secure. His problem – which he admitted to – is that he’s nearly dead.

That’s life. He’s probably not buying long-dated milk these days!

Yet what you got right is that he wants a sense of purpose. And that’s why my financial advice was – where it is prudent – for him to give away some of the excess money he was planning to leave in his will to his loved ones while he’s still alive. That way he gets to watch the joy and hear about the experiences his gifts bring.

After all, Angie, we all want a sense of purpose. Some people get it by giving away money to their loved ones in the golden years of their lives. Others get it from writing angry emails to strangers on the internet.

Scott

I Don’t Pay My Best Employee

Today I want to introduce you to the best worker I’ve ever had.His name is Robbo, and he started working for me about six months ago.

Today I want to introduce you to the best worker I’ve ever had.

His name is Robbo, and he started working for me about six months ago.

Each morning I get up at 5am and head over to the barn to start work … yet I’m always beaten by Robbo, who’s already well into his workday, quietly getting the job done.

Robbo is the nickname I’ve given to my robot mower.

When I first got Robbo, a landscaper mate of mine mocked me:

“You paid a grand for that thing? Geez, they saw you coming!”

Today he’s the one eating grass. My lawns look like a freaking bowling green.

In fact, they’re actually a little too good. People either think we have a full-time gardener, or that I’m that manic neighbour who edges his path and keeps plastic bottles on his lawn to ward off weeing dogs (you know the guy).

If you read the reviews on robot mowers they’re almost universally positive. “Why didn’t I get one of these years ago?” they say.

Probably because they weren’t invented. They’ve been around since the nineties, but they really took off a few years ago, mainly in Europe, where there are millions of them.

My prediction?

Jim’s Mowing needs to sharpen up their offering.

But don’t weed-whack me, Jim! It’s just that I can foresee that robot mowers will gradually fall in price … and in a few years you’ll have one.

That’s because they’re essentially a plastic Tonka truck (about the size of a vacuum) with a $6 cutting blade, powered by the same 20-volt battery that goes into your cordless drill.

All you need to do is lay down guidewire around the perimeter of your yard (or not – the latest robots do this automatically via GPS). It’s all hooked up to an app on your phone which assesses rainfall and calculates the growth rate of different sections of the grass (via artificial intelligence). Then it works throughout the night cutting a few millimetres off your grass with each turn (which acts like a fertiliser), before it heads back to its charging base.

For me, it means I can spend more time with my kids (who really should be mowing the bloody lawn themselves!). In fact, I’ve just now hired ‘Rodney’ – a robot vacuum – to work night shift at the barn.

Tread Your Own Path!